FAQs

Trading

If you have profits in your Funded account at the time of a hard breach, you will still receive your portion of those profits if you have the Performance Protect add-on.

For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach, we would close the account. Of the $10,000 in profits, you would be paid your 75% portion ($7,500) or ($9,000 @90%) if you chose to upgrade your performance split at the checkout.

Once you pass the Assessment, we provide you with a live account.

Yes. If you do not place a trade at least once every 60 days on your account, we will consider you inactive and your account will be breached.

Maximum Trailing drawdown is the maximum your account can drawdown before you would hard breach your account. When you open the account (1 Phase), your Max Trailing Drawdown is set at 6% of your starting balance. This 6% trails your High Water Mark until you reach 6% profits in your account. Once you have achieved 6% in your account the max trailing locks in at your starting balance, and no longer trails your account.

Please see below different scenarios:

Please note that the max drawdown for 2 Phase challenges is 10%, the below examples are for 1 Phase.

Example 1: If you start with a $100,000 account your max overall loss will be set at 6% ($6,000). This means that your account should not go below $94,000 in equity at any given time you will be in violation.

Example 2: If your account balance reaches $105,000, your max drawdown will be set at $105,000 – $6,000 = $99,000. This means your account should not go below $99,000 in equity or balance at any given time.

Example 3: If your account balance reaches anything above $106,000, your max trailing drawdown will be locked in at $100,000. This means your account should never go below $100,000 in equity or balance at any given time.

Example 4: If your account balance reaches $110,000, your max trailing drawdown will still be locked in at $100,000, giving you a 10% overall drawdown amount on the account.

Example 5: If your account balance $106,000, your max trailing drawdown will still be locked in at $100,000. This means if the following day you drawdown to 102,000. Your max trailing drawdown will still be at $100,000.

Daily Loss Limit is calculated based on the previous day’s end of day (5pm EST) balance.

Example: On a three phase account, if your prior day’s end of day balance was $100,000 you would breach the Daily Loss Limit of 5% should your equity the next day fall to $95,000.

On a two phase account, if your prior day’s end of day balance was $100,000 you would breach the Daily Loss Limit of 4% should your equity the next day fall to $96,000.

On a phase account, if your prior day’s end of day balance was $100,000 you would breach the Daily Loss Limit of 3% should your equity the next day fall to $97,000.

What trading strategies are prohibited at META FX CAPITAL?

META FX CAPITAL prohibits several trading strategies that can undermine market integrity, including but not limited to:

- High-Frequency Trading (HFT)

- The use of advanced algorithms to execute a large number of trades in fractions of a second, leading to market manipulation and instability.

- Reverse and Group Hedging

- Strategies that involve placing offsetting positions across accounts to artificially reduce market risk, circumventing risk management rules.

- Account Management

- Allowing someone else to trade on your behalf or managing multiple accounts under different names, which violates our one-account-per-customer rule. This includes “pass your challenge” services and similar services.

- Latency Arbitrage

- Exploiting delays between price updates across platforms to gain an unfair advantage, distorting true market conditions.

- Order Book Spamming

- Flooding the order book with fake buy or sell orders to create a false impression of demand or supply, misleading other traders.

- Herd Trading and Collusion

- Coordinated trading among multiple users to manipulate market actions, which undermines fair trading practices. This includes using the same EA from the same company as it would lead to coordinated trades.

- Exploiting Bugs and Glitches

- Taking advantage of any platform errors or delays to profit unfairly, which is strictly prohibited.

- High Leverage News Trading

- Placing large, leveraged positions around major news events, akin to gambling without proper risk management.

- Statistical Arbitrage

- Deploying high-risk trades based on statistical models, aiming for significant wins to offset losses from multiple accounts.

Please note these are brief descriptions, please visit this article for more detail.

Why are these strategies prohibited?

These strategies can lead to market manipulation, unfair advantages, and risk to the integrity of trading activities.

What are the consequences of using prohibited strategies?

Engaging in prohibited strategies will result in account termination and voided profits.

For a detailed explanation of each prohibited strategy, please read the full article: META FX CAPITAL Prohibited Strategies.

Furthermore, you can find more information about this in section 5.4 of our Terms and Conditions.

If you have any further questions, please contact support@metafxcapital.com.

No, you do not need to close your positions over the weekend.

However spreads may widen during these periods. We advise to manage your positions and risk during this period if you wish to hold trades over the weekend.

Yes, you can hold positions over the weekend.

Traders have to be aware of the risk of doing so. Weekend gaps are not uncommon, and markets are usually volatile and liquidity is thin when the market reopens.

We advise you to manage your risk appropriately during these trading periods.

No, you do not need to close your positions overnight.

However spreads may widen during these periods due to changes in liquidity as per real trading environments. We advise to manage your positions and risk during this period if you wish to hold trades overnight.

Yes, you can hold positions overnight.

Traders have to be aware of the risk of doing so. Liquidity generally thins out and markets become highly volatile during rollover at around 5 PM EST and this may have an adverse impact on open positions, stop losses and take profits.

We advise you to manage your risk appropriately during these trading periods.

Yes, you are able to trade new events.

Although we do not restrict news trading, traders should be aware that trades might not get filled at desirable prices due to higher volatility and lower liquidity during these times.

If you decide to hold your trades over these highly volatile periods, kindly manage your risk properly while taking wider spreads and potential slippages into consideration.

We advise you to manage your risk appropriately during these trading periods. Clients taking significant risks on news trades may be banned for improper risk management.

Our standard accounts have the following leverage 30:1 (FX & Gold) Indices 10:1, Stocks 2:1, Crypto 2:1.

We do not offer excessive leverage as this can cause traders to breach their accounts.

You can also customise the leverage at the checkout and increase it to a generous 50:1 ( FX & Gold)

Our standard accounts have the following leverage 30:1 (FX & Gold) Indices 10:1, Stocks 2:1, Crypto 2:1.

We do not offer excessive leverage as this can cause traders to breach their accounts.

You can also customise the leverage at the checkout and increase it to a generous 50:1 ( FX & Gold)

Rules

As a professional Prop Trading firm, FXIFY must adhere to Anti-Money Laundering (AML) laws and Know Your Customer (KYC) procedures. These measures are essential to ensuring the highest standards of security and compliance, protecting all our clients, and maintaining the integrity of our services.

To become a funded trader with FXIFY and receive payouts, you must successfully complete two KYC checks: one with FXIFY and another with our payment provider, Rise. If you are unable to pass either of these KYC checks, unfortunately, we will not be able to onboard you as a funded trader, nor will we be able to issue any payouts.

We only allow traders to register a single profile with META FX CAPITAL. Creating multiple profiles, including using different email addresses for the same person, is not permitted and could affect your ability to become an META FX CAPITAL-funded trader or participate in our competitions/ win in a monthly competition. Maintaining one account ensures compliance with our policies and provides a fair trading environment for all participants. If you have any questions about this, please feel free to contact our support team via live chat or email: support@metafxcapital.com.

The scaling plan works as follows: Trader has to hit 10% in the first 3 months with 2 out of the 3 months being in profit to scale up 25%. Subsequent scale up will be every 3 months and account balance doubles.

The scaling plan (for all account sizes) is as follows:

The trader must achieve a 10% return in the first 3 months, with at least 2 of those months being profitable, in order to scale up by 25%. Subsequent scaling will occur every 3 months, with the trader needing to achieve at least a 10% return and have at least 2 out of 3 months be profitable. The account balance will double with each scale up.

Example – 400k accounts in 3 months would scale up 25% making it 500k. Then every 3 months the account size would be doubled.

Months 3 500k

Months 6 $1M

Months 9 $2M

Months 12 $4M

META FX CAPIAL Performance Protect is a unique feature designed to safeguard our funded traders’ accounts in the event of a drawdown breach. This prop trading add-on provides account protection, enabling our funded traders to preserve their remaining trading gains and request a payout based on the agreed performance split, even in the face of a drawdown breach.

This innovative solution proves to be particularly advantageous for traders who have accumulated substantial trading gains and seek to safeguard them against potential drawdown breaches. With META FX CAPITAL Performance Protect, traders can confidently navigate the market, knowing that their hard-earned gains are protected and that they can continue to benefit from their trading success, regardless of any temporary setbacks.

Calculation Example of META FX CAPITAL Performance Protect:

To illustrate how META FX CAPITAL Performance Protect add-on works, let’s consider a hypothetical scenario. Here’s what you need to know:

- Starting Balance: $100,000

- Highest Equity Reached: $130,000

- Daily Drawdown (DD): -$6,500 (5% DD breached)

Ending Balance: $123,500

Without Performance Protect, the trader’s funded account would be closed, and all existing gains would be forfeited. This is not the case with META FX CAPITAL Performance Protect.

With the Performance Protect add-on, the trader can request a payout of the remaining gains, in this case, $23,500, which will be distributed accordingly based on the agreed-upon performance split. This not only saves the trader from losing all their hard-earned profits but also provides a safety net in the event of adverse market conditions.

How to Purchase META FX CAPITAL Performance Protect:

META FX CAPITAL Performance Protect is offered as an add-on to all prop traders of META FX CAPITAL . This add-on can be added at checkout upon choosing your META FX CAPITAL assessment, pricing at just an additional 15% of the assessment fee. It’s important to note that the add-on must be purchased during your META FX CAPITAL assessment checkout and cannot be acquired separately upon advancing to the funded stage. By making a thoughtful decision from the start, you can safeguard your trading gains and benefit from them in your funded stage.

If you have profits in your Funded account at the time of a hard breach, you will still receive your portion of those profits if you have the Performance Protect add-on.

For example, if you have a $100,000 account and you grow that account to $110,000. Should you then have a hard breach, we would close the account. Of the $10,000 in profits, you would be paid your 75% portion ($7,500) or ($9,000 @90%) if you chose to upgrade your performance split at the checkout.

The rules for the Funded account are exactly the same as your Assessment account. Please note that the 1, 2, and 3 phase assessments have different parameters and drawdown rules so make sure you check which is best for your trading strategy. However, with a Funded account, there is no cap on the performance you can achie

Payouts

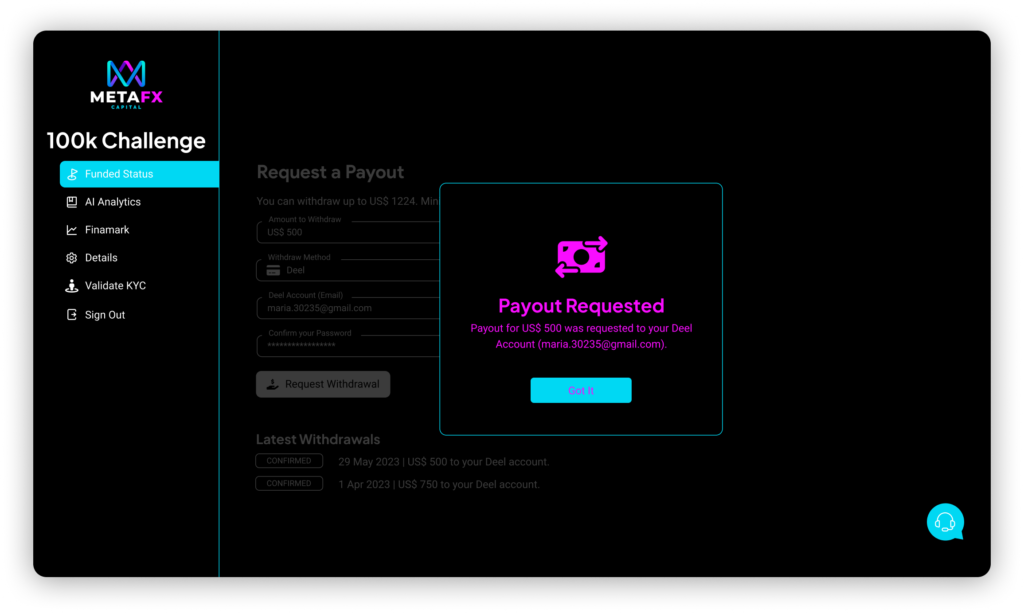

We process withdrawals Monday – Friday 9AM -9PM GMT.

Please note the following:

-If you request a withdrawal over the weekend it will be processed on Monday which is the next business working day.

-If you request a withdrawal after 9PM GMT (Monday – Friday) it will get processed the following day.

There also may be a delay in withdrawals around UK public holidays.

If you request a withdrawal please make sure to fill out/update the withdrawal request form which should be attached into the email when you requested a payout.

Refunds are processed when a trader makes their first withdrawal, which is available 14 days after your frist trade. We process 100% of the original order value placed by the trader. This does include any add-ons purchased.

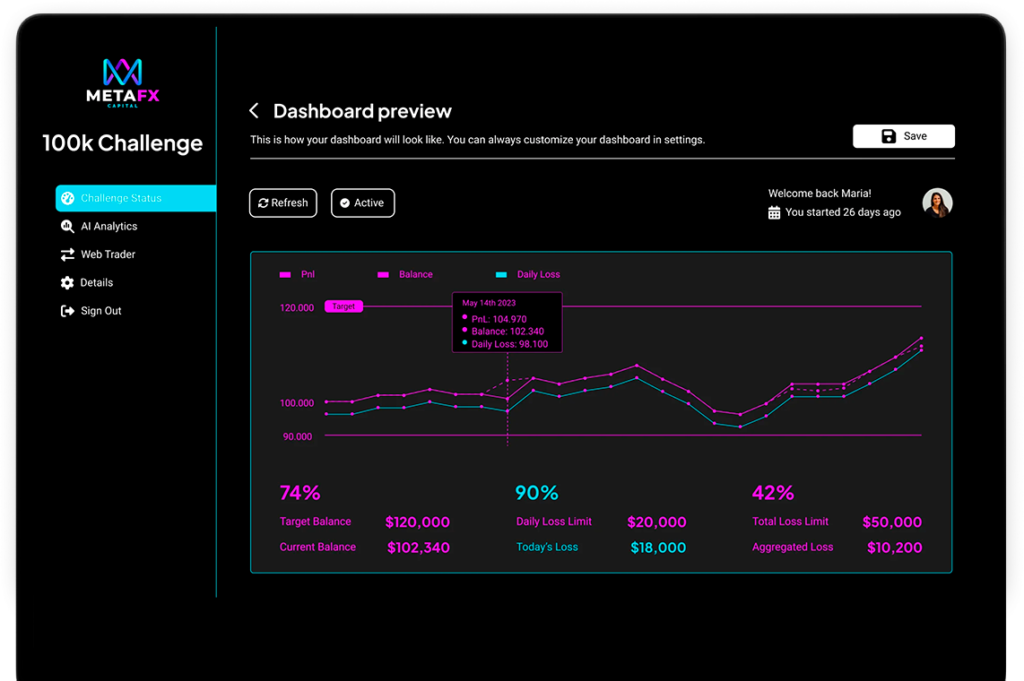

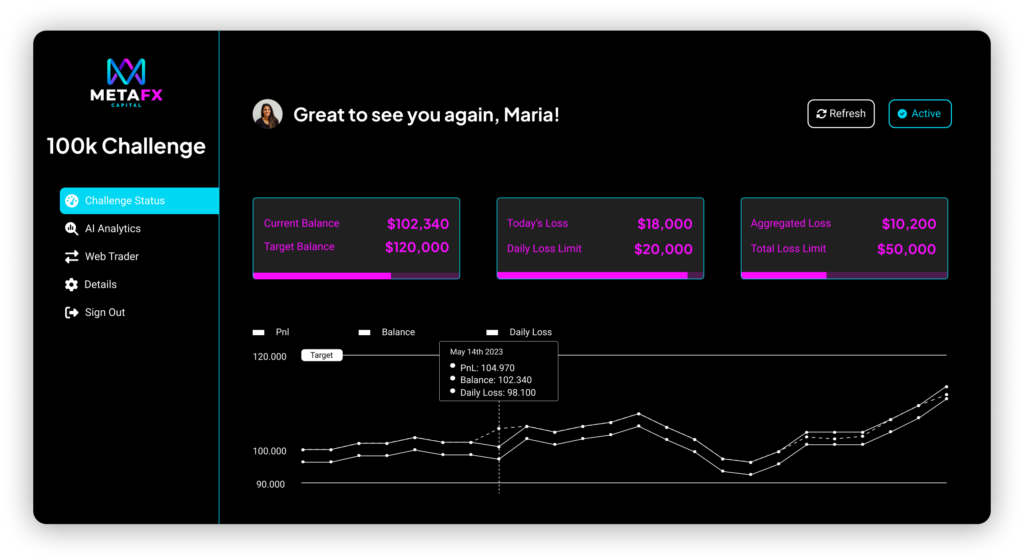

Traders can request a payout in their trader dashboard .The first withdrawal can be requested 14 days after your frist trade.

Additionally, if you want to leave profits in the account and let them compound to scale your account you have the flexibility to do so. Upon requesting a withdrawal, your account will be set to read-only until the withdrawal is approved.

Please note for 1 phase live account, the max drawdown will lock in at your starting balance after receiving your payout.

1 phase live account payout example:

You have taken an account from $100,000 to $120,000. Your account had a 75% profit share. You then request a withdrawal of $14,000. In this scenario, we would pay you $10,500 (75%) and we would retain $3,500 (25%). This would also take the balance of the account down to $106,000, and your max loss limit is locked in at $100,000. So, you would have $6,000 maximum you could lose on the account before it would violate the maximum trailing drawdown rule.

*Please note you are entitled to a full withdrawal, however in doing so, you will forfeit the funded account ( on 1 phase accounts ).

*For all payouts, please make sure to fill out/update the payout request form which will be included in your payout email. We will not be able to process a payout unless we have the relevant details provided in the form.

You will be eligible for a full refund of your original purchase when you request your first withdrawal with us.

*Please note that if you breach the account and it is not in profit then the refund will not be available as it is only included and processed along with the first withdrawal

Orders & billing

You may apply for the META FX CAPITAL 1 phase assessment and 2 phase assessment and 3 phase assessments, by configuring your account parameters here. After you submit the order form, you will be redirected to the payment page. Once the payment is successful, you will receive the order confirmation email.

We do not charge any additional or hidden fees. You are able to customise your 1 phase and 2 phase assessment at the checkout if you wish, which carry a one time charge. The fee covers the challenge and verification (for 2 phase), we do not charge any recurring fees.

Your assessment fee will also be reimbursed to you with your first payout on request.

What is an underpayment, what happens, options for having an underpayment. Important – the customer needs to contact us for wallet address instead of just sending more funds to the original wallet.

Refunds are processed when a trader makes their first withdrawal, which is available on 14 DAYS AFTER YOUR FRIST TRADE. We process 100% of the original order value placed by the trader. This does include any add-ons purchased.

For more details, please refer to our Terms and Conditions or contact support@metafxcapital.com.